by Aidan Poole Payment orchestration specialist BR-DGE has entered into an agreement with Kenwood Travel, a British luxury tour operator, to meet the growing demand for international travel. The agreement provides Kenwood Travel with payment orchestration technology for seamless online payment and the BR-DGE platform of more than 300 payment …

Read More »Bournemouth release Newcastle ticket allocation – Good news

Bournemouth are the team that will provide the next competitive opposition for Newcastle United. A League Cup fourth round match at St James’ Park on Wednesday December 21, 29 days away. Bournemouth have now revealed their ticket allocation for the match. Official announcement from Bournemouth – 22nd November 2022: “Ticket …

Read More »Former CEO of Dorset Clinical Commissioning Group joins palliative care charity as board trustee

A former chief executive of the Dorset Clinical Commissioning Group has joined Lewis-Manning Hospice Care as a board trustee. Tim Goodson has extensive experience in the healthcare industry. He is an experienced NHS Board Member, System Manager, Company Director and a qualified CCAB Accountant with experience providing support and advice …

Read More »3 property bargains you might find at auction in the Bournemouth area

Drivers warned of £5,000 fines ahead of Qatar World Cup

Football fans getting excited about the World Cup in Qatar are being warned not to get carried away behind the wheel or they could face fines of up to £5,000. The host nations are preparing for their opening matches at the World Cup, with the tournament due to start this …

Read More »Richard Drax criticizes Jeremy Hunt’s fall statement

Jeremy Hunt’s autumn statement was criticized by one of Dorset’s Tory MPs. South Dorset MP Richard Drax has warned of the government and opposition ‘promising to spend billions’ of extra pounds. Mr Drax told the Commons: “I have immense sympathy for my right hon. friend, we are facing serious financial …

Read More »Awards for Bournemouth Coastal BID

A Boscombe innovation has helped Bournemouth Coastal BID win two awards, including the coveted ‘Place Management’ title at the British BID Awards. Boscombe’s huge spotlight was the move that wowed the judges and saw 19 other entries that made it to the shortlist. It was the country’s first permanent 3D …

Read More »Pediatricians call for more federal aid to fight RSV wave | app

WASHINGTON — After two winters spent masked and 6 feet away, pediatric respiratory viruses have returned with a vengeance, and pediatric hospitals, ER doctors and pediatricians are pressuring Congress and the Biden administration to provide more support . Children’s hospitals deal with a wave of respiratory syncytial virus, also known …

Read More »Sunak vows to support allies as Russian-made missiles hit Poland

Rishi Sunak said Britain would “support our allies” but said it was “unlikely” Russia fired a missile that killed two people in Poland on Tuesday. The prime minister’s comments came as Joe Biden pledged US support for Poland, with US intelligence suggesting the missile was fired by Ukrainian forces at …

Read More »Shop locally with free parking before Christmas

There will be free parking on certain days at the end of November and December in selected car parks in the Dorset Council area. To encourage residents to support local businesses by shopping locally and attending events, free parking will be available on Small Business Saturdays which takes place on …

Read More »Pristine Bowral Estate Features in Today’s Property Highlights

In today’s luxury property highlights, discover an immaculate estate in scenic Bowral, a prime opportunity for lavish waterside living in Paradise Waters and a waterfront masterpiece of the river at Mount Pleasant. 16 Mount Street, Pyrmont, New South Wales 2009 Perched on Darling Harbour, Pyrmont is a waterfront suburb with …

Read More »Our valleys thrive on STEAM

For decades, Roanoke’s economy has run on steam. Appropriate, then, that STEAM could be what propels Star City into the future. The acronym STEAM is a modification of STEM, which stands for science, technology, engineering and mathematics. Once home to the mighty Norfolk and Western Railroad, later Norfolk Southern, Roanoke …

Read More »Several emergency services respond to an overturned car

A car overturned on a busy road near Wimborne this afternoon, prompting several emergency services to respond. Emergency services were called to a single vehicle accident on the B3082 Blandford road just before 3pm on Sunday November 13. Two fire engines were present during the crash, involving only one car, …

Read More »Schools face £2.1m funding cuts in Dorset

SCHOOLS in Central Dorset and North Poole will face £2.1million in spending cuts next year – according to a teachers’ union. The figures indicate that schools in the region will have £169 less to spend per pupil next year (2023/24) than this year (2022/23). In total, all but one of …

Read More »Bournemouth rejoiced when the dark clouds of war finally parted

Armistice Day in Bournemouth 1918 – ‘Receiving News from the Daily Echo Office’ Crowds gathered outside the Echo Office to hear the announcement of the signing of the Armstice declared from the steps by Mr HJ Cheverton, general On Remembrance Sunday tomorrow, the Echo looks back on World War I …

Read More »Fintech can help promote economic growth: minister

Jakarta (ANTARA) – Digital financial platforms, or financial technologies (fintech), can help boost national economic recovery and growth, according to the Coordinating Minister for Economic Affairs, Airlangga Hartarto. “The digital finance sector has very promising potential. Thus, the existence of various digital financial platforms as national players should support the …

Read More »RMT calls off ScotRail strikes after rail company raises wage offer

Union members embroiled in a bitter dispute with the nationalized Scottish Railway have called off strikes and will vote on whether or not to accept a pay rise from the company. The Rail Maritime and Transport (RMT) union had threatened ScotRail with Christmas chaos and told bosses of the public …

Read More »Former duo Cherries named in England’s World Cup squad

Flood protection advice in Dorset

A COMMERCE body has compiled a list of measures Dorset households can take to protect their homes from flooding. It is part of the Flood Action Week, an initiative led by the Environment Agency encouraging those living in areas at risk of flooding to act now to protect their homes, …

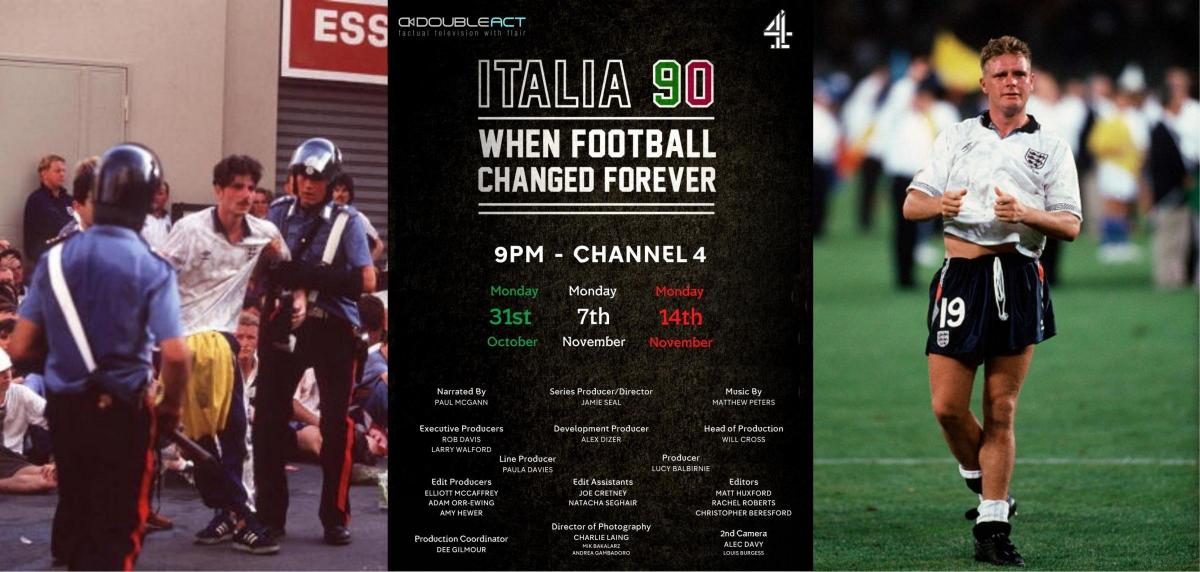

Read More »Parker thinks Trippier is injecting toughness into the Newcastle defense

Kieran Trippier has injected much-needed toughness into the Newcastle defense and is recovering under Premier League pressure, according to former England full-back Paul Parker. But the Italia 90 star admits the Magpies right-back still has a lot of work to do if he is to make his way onto the …

Read More »Publication of Steve Belasco’s book Jurassic Coast from the Sea

A new book celebrating the Jurassic Coast from an unusual perspective is the culmination of a photojournalist passion project. Steve Belasco has just released his third book of photographs of the Jurassic coast taken from a boat. His book Jurassic Coast from the Sea features stunning photos of the World …

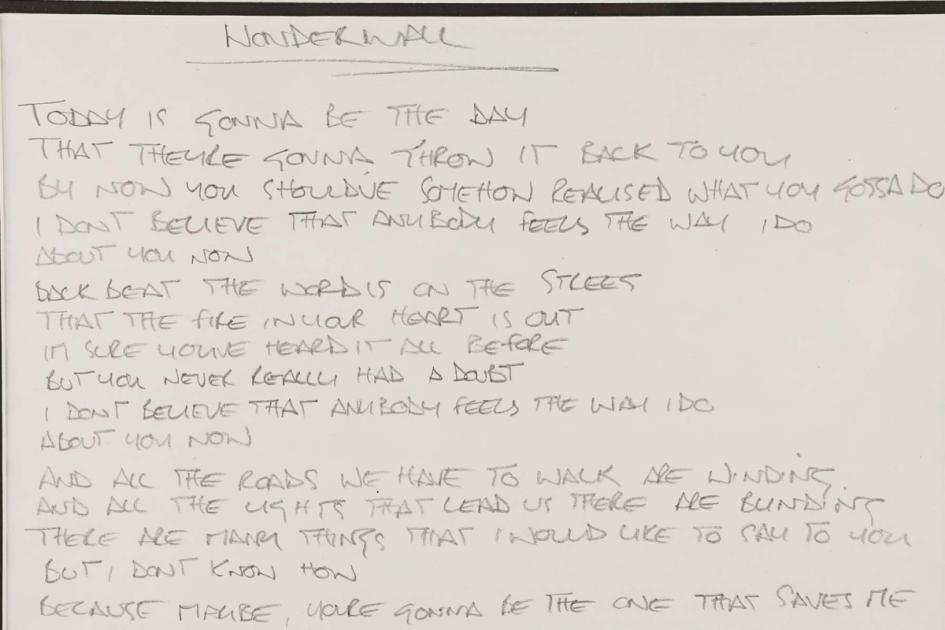

Read More »Noel Gallagher’s handwritten lyrics for Wonderwall sold for £46,875 at auction

A piece of paper with the lyrics to Wonderwall handwritten by Oasis star Noel Gallagher fetched £46,875 at auction after going under the hammer on Friday. The page with the hit song in pencil is believed to have been written to help Gallagher during band rehearsals. Handwritten lyrics by Noel …

Read More »Taylor Swift adds 8 new dates to The Eras Tour, her first tour in 5 years

Taylor Swift has added eight more shows to the first leg of “The Eras Tour,” days after announcing her first set of live performances since touring for her 2017 album, “Reputation,” in 2018. Fast said in a tweet the tour will be “a journey through the musical eras of my …

Read More »Dorset village makes history as three norths meet in ‘once in a lifetime’ discovery

Bournemouth Echo: Three map norths meeting at Langton Matravers Reunion of the three map norths at Langton Matravers (Image: Ordnance Survey) Mark Greaves, earth measurement expert at Ordnance Survey, said: “It is no exaggeration to say that this is a one-time event that has never happened before. “Magnetic north moves …

Read More »Refurbishment of four beach toilet blocks in Bournemouth and Poole

FOUR seafront toilet blocks across the conurbation are being refurbished this winter as part of a £300,000 investment. The upgrades are being made to facilities in Bournemouth West, between Happyland Amusements and the West Beach restaurant, Bournemouth East, next to Harry Ramsden’s fish and chips, Sandbanks, next to the car …

Read More »Digital Finance Market 2022-2029, Global Industry Size,

Digital Finance Market 2022-2029, Global Industry Size, Growth, Scope, Share, Regional Competition Landscape, Porter’s Five Digital Finance Market Research Report: A Brief Summary • The study offers details of the major organizations and companies operating in the market, so that research clients can understand how the major market players continue …

Read More »Reduced speed limit on highways to tackle oil addiction suggested

The International Energy Agency has proposed a ten-point plan to reduce global demand by 2.7 million barrels per day. The plan includes a ban on driving cars in cities every Sunday, as well as a suggestion to reduce speed limits on motorways by 6mph. The plan also calls for working …

Read More »Road.Travel addresses the charging of electric cars…

The brand claims that electric vehicles are the most cost-effective means of transport and that the demand for such vehicles is growing by Aidan Poole Destination management organization Road.Travel has introduced a solution to make electric vehicle journeys more convenient and turn travelers into high-value travellers. The brand said electric …

Read More »Have your say on our community governance review

At its full council meeting on October 20, Dorset councilors agreed to carry out a new review of community governance for several of Dorset’s current parish and town councils, which have been removed for public consultation. They include the parishes forming Vale of Allen Parish Council, Winterborne Farringdon Parish Council …

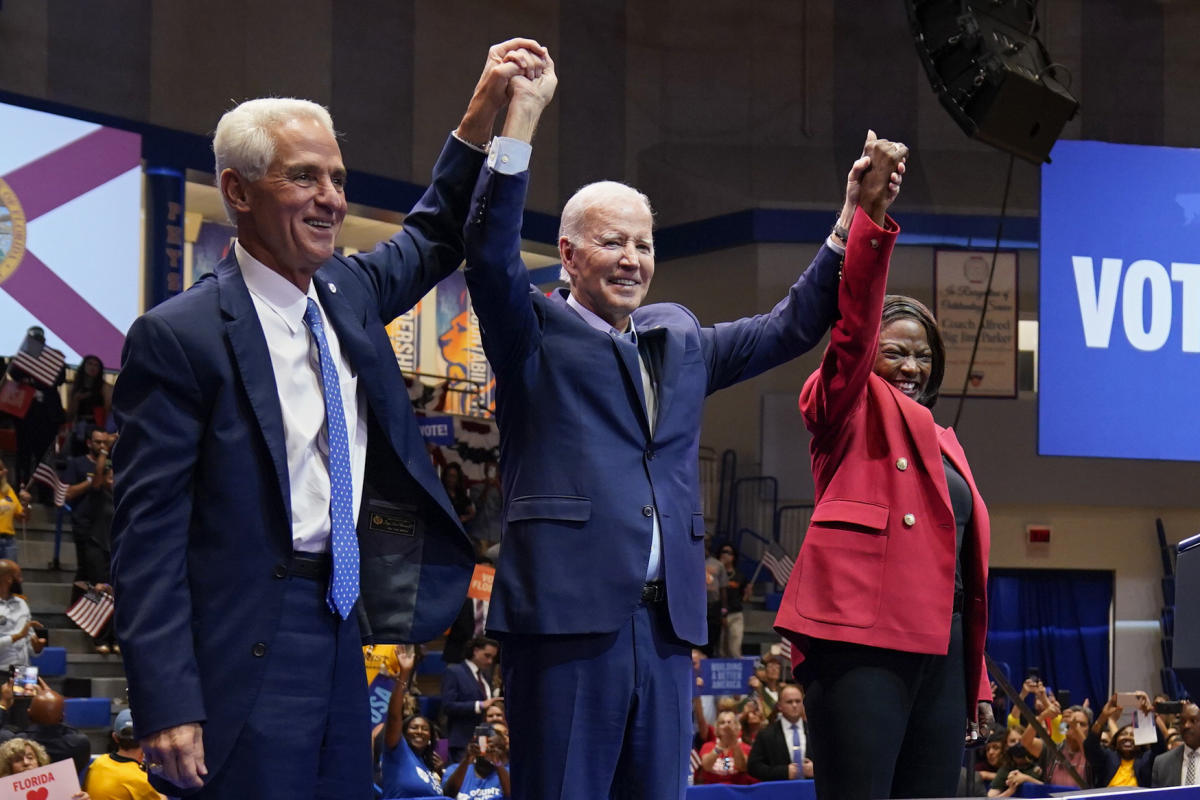

Read More »Biden tears up GOP, calls DeSantis ‘Trump incarnate’

MIAMI GARDENS, Fla. (AP) — President Joe Biden on Tuesday lashed out at Republican Florida Governor Ron DeSantis as “Donald Trump incarnate,” focusing on a potential 2024 GOP presidential candidate as he was campaigning for Democrats facing tough fights in next week’s midterm election. In a final week sprint for …

Read More »Peer-to-Peer (P2P) Lending Market Outlook 2022, Price

According to IMARC Group’s latest report “Peer to Peer (P2P) Lending Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027”, the global Peer to Peer (P2P) Lending Market reached a value of US$112.9 billion in 2021. Looking ahead, IMARC Group expects the market to reach US$525.3 billion by …

Read More »Poole Christmas Maritime Light Festival: what’s going on?

The Poole Christmas Maritime Light Festival will kick off in November and run until the New Year. Here’s everything you need to know about the attraction set to shine this festive season. What is that? Poole Christmas Maritime Light Festival is billed as Poole’s answer to Bournemouth’s popular Christmas Tree …

Read More »Antonio Conte praises Tottenham’s attitude in spectacular return to Bournemouth

Sign up for the free Reading the Game newsletter by Miguel Delaney sent straight to your inbox Sign up for the free weekly newsletter from Miguel’s Delaney Tottenham boss Antonio Conte was relieved to see stoppage time winner Rodrigo Bentancur count for Bournemouth and admitted he fears a heart attack …

Read More »Goats, dogs, cats and rabbits in need of homes in Dorset

GOATS, dogs, cats and rabbits are looking for their forever homes. Dorset-based animal rescue center Margaret Green hopes to find forever homes for a number of animals currently in its care. Can you help ? All the details are below. nox (Picture: Margaret Green Animal Rescue) Nox is a seven-month-old …

Read More »27/10/2022 | Voice of the Readers – October 28, 2022

Berlin residents share concerns over new response fee BERLIN — Residents continue to worry about new emergency response fees introduced by the Berlin Fire Company. Resident James Walsh addressed the Berlin City Council on Monday to express his frustration at the response fee now being charged by the Berlin Fire …

Read More »The crypto asset market in Indonesia is weakening. What is the solution?

Jakarta, Indonesia, October 27, 2022 /PRNewswire/ — The Crypto Asset Industry in Indonesia is still in the focus of many parties due to its development. Compiled from the latest data from the Commodity Futures Trading Regulatory Agency (CoFTRA) at August 2022crypto asset investors have penetrated 16.1 million clients, but on …

Read More »“I am excited about the challenges ahead,” says Georgina after taking over as Poole BID chair

Georgina Bartlett is the new chairman of the Poole Business Improvement District (BID). She fills a vacant position since the resignation of the previous president in January this year. Georgina will be supported in this role by Sara St George who was elected Vice-Chair by the Poole BID Board at …

Read More »Bournemouth vs Tottenham LIVE – Bournemouth AIM to UPSET struggling Tottenham – Follow LIVE

Bournemouth vs Tottenham LIVE – Premier League LIVE – AFC Bournemouth welcomes top 4 contenders Tottenham Hotspur to the south coast in the… Bournemouth vs Tottenham LIVE – Premier League LIVE – AFC Bournemouth welcomes Top 4 contenders Tottenham Hotspur to the Premier League south coast on Saturday. The Cherries …

Read More »Push to divest oil and gas from Dorset Pension Fund

Dorset Council and the county-wide Dorset Pension Fund, which involves other public bodies, are again under pressure to divest from oil and gas. Activist Caz Dennett says now is the time to invest in something for good. She asked the fund, whose main contributors are Dorset Council and Bournemouth, Christchurch …

Read More »#TheGoodStuff: Trying new ideas | Opinion

At a recent out of town meeting, I was speaking with someone from the State Department of Commerce. He lives in the Pauls Valley area and travels throughout southwestern Oklahoma to meet with economic developers. I asked if long trips were difficult for him and he told me he loved …

Read More »Avant sees credit cards as its future

Bochenek makes no apologies, saying Avant provides a service to consumers whose alternatives would otherwise be more expensive when they need credit. “If Avant and others (subprime lenders) aren’t there to provide access, what’s the alternative?” he says. “The alternative is usually extremely expensive payday lenders.” This is a strong …

Read More »Weather: 20C forecast for Bournemouth ahead of Halloween

TEMPERATURES are expected to get awfully hot as we heard around Halloween. We could see highs of over 20C by the end of the week, said Bournemouth-based forecaster Bournemouth & Poole Weather. Providing perspective this morning, the weather enthusiast said: “Well a calmer day today. “Fewer showers and definitely less …

Read More »Builders warn of a long wait as labor shortages and supply chain disruptions plague the industry

Jackie Poole has slowly begun renovating the Central Queensland home she shares with her husband and two sons. She says since the family bought the Rockhampton home in 2015, they’ve turned it into their “dream home” – almost. ‘We are hoping to get the kitchen refurbished which would involve extending …

Read More »Massive hedge longer than Hadrian’s Wall to span the full length of Dorset

Ten different plants should be used, including honeysuckle, elm, hawthorn, dogwood and blackthorn. This trail has been around for 27 years and runs from Forde Abbey in the west, across Dorset to Bokerley Dyke in the east. However, the group also hopes to plant other hedges along four small hiking …

Read More »West Ham vs Bournemouth: Kick-off time, predictions, TV, live stream, team news, results h2h

David Moyes saw his side’s good run come to an end at Liverpool on Wednesday, but the manner of their second-half performance certainly proved encouraging. In the grand scheme of things, a narrow defeat at Anfield is hardly fatal to West Ham’s attempts to lift the Premier League, such has …

Read More »Wordle today: Wordle 489 October 21 tips and today’s answer

Wordle has taken the world by storm, and if you haven’t given in to the daily game, we can guarantee you’ve seen the elusive squares all over social media. The game uses the same rules as Scrabble, where only real words are allowed in both the guesses and the outcome. …

Read More »15 fantastic things to do in Vancouver this weekend: October 21-23

Another fall weekend has arrived and it’s filled to the brim with great events and activities! Plan your days with our checklist of 15 fantastic events happening in Metro Vancouver from October 21-23. Diwali Fest, burlesque tribute to Kate Bush, and more. And for more fun things happening around town, …

Read More »Country Diary: Quarries dot the milky blue Channel coastline | Coastlines

Ahead, the lowered ruins of Corfe Castle tower over the gap in the chalk ridge. Here, on neighboring commons, yellow tansy, mauve watermint and thickets of ripe sloes, hips and hawthorn brighten up the splashy, rolling land. Climbing to Challow Hill from Corfe our gaze down is necessarily focused on …

Read More »Dive boat captain faces new charge in California’s worst modern maritime disaster that killed 34 | app

LOS ANGELES — More than three years after 34 people were killed in the worst maritime disaster in California’s modern history, the captain of the dive boat Conception faces a new federal indictment amid a legal battle over his guilt rages. Jerry Nehl Boylan, 68, of Santa Barbara, was indicted …

Read More »Gary O’Neil makes strong case for Bournemouth job | Bournemouth

Had the Premier League season started on August 30, when Gary O’Neil was appointed caretaker manager of Bournemouth after the dismissal of Scott Parker, the club would be fifth in the table, just five points behind Arsenal. Bournemouth have picked up 10 points from six games under O’Neil. They have …

Read More »Online instant payday loans for bad credit

payday loans for bad credit Get 100% cash advance online even with bad credit. The best service for fast loans! payday loans for bad credit Payday loans, however, are a different breed of loan. These loans are short-term and high-interest, usually repayable within a few weeks. Additionally, payday loans for …

Read More »Dorset hunter found guilty of illegal fox hunting with dogs

A HUNTER has been found guilty of illegal hunting after he ‘encouraged’ his out-of-control dogs to kill a fox. Mark Pearson, 64, was observed yelling ‘go on’ and ‘hunt’ to his dogs after they chased and attacked the animal during a trail hunt. The co-master of the South Dorset Hunt …

Read More »Warriors launch title defense as NBA season kicks off

MILAN: Next year the Giro d’Italia will take place almost entirely on the Italian mainland. The 2023 Grand Tour of Italy route was unveiled at a ceremony in Milan on Monday. It will start in Abruzzo, as announced last month, and end in Rome. The Giro will not pass through …

Read More »Biz People: the chef passes the baton; Peter dons his whites; Kerry’s Special Dance Competition Rival

Hotel chef hands over after three decades Everything changes in the kitchen of one of Bournemouth’s top hotels as the head chef more than three decades behind hangs up his whites. This month saw the end of a 32-year career as head chef at the Miramar Hotel on East Cliff …

Read More »Live Updates: Bank of Canada Announces Biggest Drop in Trade Outlook Since 2020

Hello and welcome to the working week. Or should it be workers week? The 20th National Congress of the Communist Party of China is underway in Beijing and all eyes are on President Xi Jinping ahead of the scheduled vote to give him an unprecedented third term. The Financial Times …

Read More »Construction costs are rising at record rates – could a home improvement loan help?

New reports from Corelogic’s Cordell Construction Cost Index (CCCI) indicate a record growth rate in home construction costs in the year to September 2022. If you were looking to make changes to your home, you could suffer an unpleasant shock. . In the 12 months since September 2021, construction costs …

Read More »Truss offers to save PM amid growing Tory unrest

Liz Truss will try to salvage her premiership this week, her fate depending on the mood of the market and her own backbench MPs. All eyes will be on the market reaction on Monday morning, after the Prime Minister appointed Jeremy Hunt as chancellor and effectively scrapped his economic program …

Read More »Brockenhurst 4-0 Portland United: Badgers stifle Blues invincibility

PORTLAND United’s six-game unbeaten streak was abruptly cut short as Brockenhurst cruised to a 4-0 win over their Wessex League Premier Division counterparts. Perhaps still feeling the scars of former co-manager Sam Poole’s departure, Portland trailed the Badgers 3-0 at halftime. Kieran O’Donnell’s cross was converted by Mitch Speechley-Price in …

Read More »HMRC issues self-assessment scam warning ahead of October tax deadline

HMRC has issued a warning ahead of the 2021-2022 self-assessment deadline, urging customers to beware of scams. In the 12 months to August 2022, HMRC responded to over 180,000 suspicious contact referrals from the public, of which almost 81,000 were scams offering bogus tax refunds. Criminals claiming to be from …

Read More »Dorset Council submits proposals for three potential investment areas

Dorset Council today submitted three Expressions of Interest to the Government for potential investment areas in Dorset. These are: Weymouth – several waterside regeneration sites in Weymouth Harbor and Marina. The proposal is to redevelop disused and underdeveloped sites to provide housing and …

Read More »“Here, every game is 100%”

AFC Bournemouth v Brentford in the Premier League season at the Vitality Stadium. Marcos Senesi and Philip Billing..Photo by Richard Crease. MARCOS Senesi has upgraded to the Premier League after a baptism of fire to start his life in England. Thrown into the fray in the heavy 4-0 defeat at …

Read More »Kevin Spacey’s accuser denies ‘straying from specificity’ with claims

Anthony Rapp has denied telling the author of an article in which he accused Kevin Spacey of an “unwanted sexual advance” to “get away from specificity”. The actor said the alleged incident was the “most traumatic event” of his life – as he sought to clarify aspects of a fierce …

Read More »Weymouth Football Club Cafe is Echo Cafe of the Year

Savvy diners have voted for a much-loved coffee to win a prestigious award for the second year in a row. The Weymouth Football Club Café has been crowned winner of the Dorset Echo’s Café of the Year 2022 competition. The cafe came out on top after hundreds of votes and …

Read More »Letters: Gas Island | Chavez’s intentions

Submit your letter to the editor via this form. Read more Letters to the Editor. Special blend madestate a gas island Re. “Newsom targets drifting gasoline prices”, page A1, October 8: Much is written about the absurdly high gas prices in California compared to the rest of the country. The …

Read More »Nurses in Dorset will vote on strike action this month

NUSRES does not want to strike, but if it does, it will not let its patients dry out. That was the message given today by the chairman of the Royal College of Nursing Congress, who said nurses would not take the decision lightly if they voted for the action when …

Read More »New 50p BBC centenary coin unveiled by Royal Mint

The Royal Mint has unveiled a new 50p coin, created to celebrate the BBC’s centenary, which will feature an image of the late Queen Elizabeth II. Indeed, the coins were produced before the death of the queen in September, so they will not feature an effigy of King Charles on …

Read More »Hunter’s Moon: share your photos of Dorset with us

THIS stunning photo shows the moon rising off the Dorset coast last night. The scene over the Isle of Wight was captured by Peter Hadfield of the Echo Camera Club. The October Full Moon is expected to peak tonight, Sunday, October 9. The full moon in October is known as …

Read More »Night of triumph as the hospitality industry’s unsung heroes take their place in the spotlight

They are often unsung heroes, but they have now received well-deserved recognition for the role they play in BCP’s multi-million pound hospitality business. Waiters and waitresses, clerical staff – including HR, administration and accounting – as well as maintenance, night staff and kitchen porters were among the roles honored at …

Read More »Key dates for potential strikes and industrial action affecting the UK

Further strikes are expected across the UK amid continuing labor disputes over pay, jobs and conditions. Strikes or ballots for industrial action have become commonplace as workers across the country join the growing campaign for wage increases to match soaring inflation amid the cost of living crisis . The new …

Read More »Money-saving tips to reduce winter energy bills

American households could see their energy bills rise in the coming months, as the federal government warned that the price of electricity is likely to continue to rise during the winter. The U.S. Energy Information Administration forecasts the average price of electricity for residential consumers could reach 15.86 cents per …

Read More »Curry, Sir Alex Ferguson, Southbourne Beach and Adam and the Ants feature in our 20 Q&A

Every week we shine the spotlight on a leader in Dorset and ask them for answers to our half-fun/half-serious quiz. This time… Her favorite smell – and food – is curry; he would like to share a car with Sir Alex Ferguson and gets angry at people who don’t keep …

Read More »Dreamforce data suggests SF tourism is rebounding

The Dreamforce 2022 convention is just a memory now. However, new data analyzing its impact on San Francisco is beginning to show positive indications for the city’s struggling tourism industry. A recent data report compiled by SRT, a global hotel data and analytics company, analyzed hotel occupancy in San Francisco’s …

Read More »Great Dorset Steam Fair will not be back in 2023

LA Great Dorset Steam Fair will not take place in 2023, organizers have announced. In a statement, organizers said the event, to be held at Tarrant Hinton, would return in 2024 after a “thorough review” of this year’s event and the decision had been “extremely difficult” to make. “Significant and …

Read More »Voters Roundtable: Conservative voters on what motivates them to vote midterm

Sign up for the On Point newsletter here. Republicans have a chance to retake the US House and Senate in November’s midterm elections. According to a recent poll, eight in 10 Americans rate the economy as “only fair” or “poor,” and more than two-thirds say the economy is getting worse, …

Read More »Successful first year for corporate training resource provider | Wales Business News

Photo caption – back row – Jacob Hughes (Swansea.Com), Jayne Brewer (CEO of 2B Enterprising), Richard Jones (Vice Principal) and Julie Thomas (1/2 year teacher). In the front row – Pupils from Pontybrenin primary school A Swansea-based business education resource provider has celebrated a successful first year in business. 2B …

Read More »EPL: Bournemouth held by Brentford deadlocked | Soccer News

Bournemouth and Brentford played out a goalless draw in their first top-flight encounter at Vitality Stadium on Saturday as the two sides endured a frustrating afternoon in the premier league with few clear chances. The hosts saw a penalty appeal dismissed in the 20th minute when Kristoffer Ajer challenged Jordan …

Read More »House prices in Bournemouth Christchurch and Poole: average house prices rise by £4,000

House prices in Bournemouth Christchurch and Poole rose by an average of more than £4,000 in the month of July, according to figures from the Land Registry. The latest data from the Government Department reveals that in July 2022 average house prices in Bournemouth Christchurch and Poole reached £347,479. This …

Read More »House prices in Dorset: average house prices rise by £100

House prices in Dorset rose by an average of more than £100 in the month of July, according to figures from the Land Registry. The latest data from the government department reveals that in July 2022 average house prices in Dorset reached £360,661. This figure was up from £360,475 in …

Read More »The Bournemouth Christmas Tree Wonderland countdown begins

Locals don’t have long to wait to enjoy Bournemouth’s Christmas tree wonderland. Now in its fifth year, this free attraction runs from Friday, November 18 through Monday, January 2, 2023. It promises to dazzle and delight with its iconic 60-foot Christmas tree with light shows set to music, as well …

Read More »Things to do in the Houston area this weekend: September 30

article Pumpkins hang from a tunnel at the Houston Zoo. HOUSTON – Step out into the refreshing fall air and usher in October with a food and drink festival, seasonal photo op or Halloween-themed entertainment. Here are some of the things to check out in the Greater Houston Area this …

Read More »Ramaphosa in South Africa denies money laundering allegations

South African President Cyril Ramaphosa has denied money laundering allegations as he was questioned by politicians over a scandal that threatens his position and the leadership of Africa’s most developed economy. Mr Ramaphosa is already under investigation by police and a parliamentary-appointed panel for the theft of a large sum …

Read More »Dorset Echo and NatWest Business Support Campaign

A campaign to support businesses during the cost of living crisis is launched by the Echo of Dorset and Nat West. Rising inflation, rising export costs and steadily rising energy prices are placing small and medium-sized businesses under unprecedented pressure. And for many, this winter could be the tipping point, …

Read More »Provident Financial plc on ‘sloppy valuation and very good performance’, says fund manager (LON:PFG)

Provident Financial plc (LON:PFG) was the subject of conversation when DirectorsTalk sat down with fund manager, Gervais Williams. We asked Gervais which companies have plenty of opportunities in light of current market conditions in The Diverse Income Trust plc’s portfolio. “Provident Financial, and financial companies in particular, sometimes survive quite …

Read More »Buncombe County plans to add 80,000 by 2045. Housing density to come?

ASHEVILLE — A first-of-its-kind project creating a roadmap for the next 20 years is poised to change Buncombe County’s growth forever, particularly with respect to housing density and the risk of gentrification as the county’s population is expected to increase by almost 30%. After a year of public comment and …

Read More »Rodrigo Riquelme: ‘The fate of Bournemouth gave me a reality check’

Atletico Madrid playmaker Rodrigo Riquelme credits his loan spell with Bournemouth as the springboard for his development in the professional ranks. Atlético Madrid game leader Rodrigo Riquelme revealed that he considers his loan period to Bournemouth as the most important step in his career. The 22-year-old is currently enjoying his …

Read More »Dorset Council takes action to reduce energy use in libraries

Dorset Council has installed a host of energy saving measures in Dorset libraries with the aim of reducing carbon emissions and energy costs. Over the past six months, the council has installed a wide range of energy efficiency and renewable energy measures at fifteen library sites in the council area. …

Read More »Changing Global Risk Landscape Goes Beyond Organizational Readiness, Says Global Report From AICPA and CIMA and NC State Poole College of Management | app

NEW YORK–(BUSINESS WIRE)–Sep 27, 2022– As global organizations face an increasingly complex risk environment, a new report released today by AICPA & CIMA and the State of North Carolina revealed that the majority have weak approaches to risk management and immature ERM processes. The report found that around 60% of …

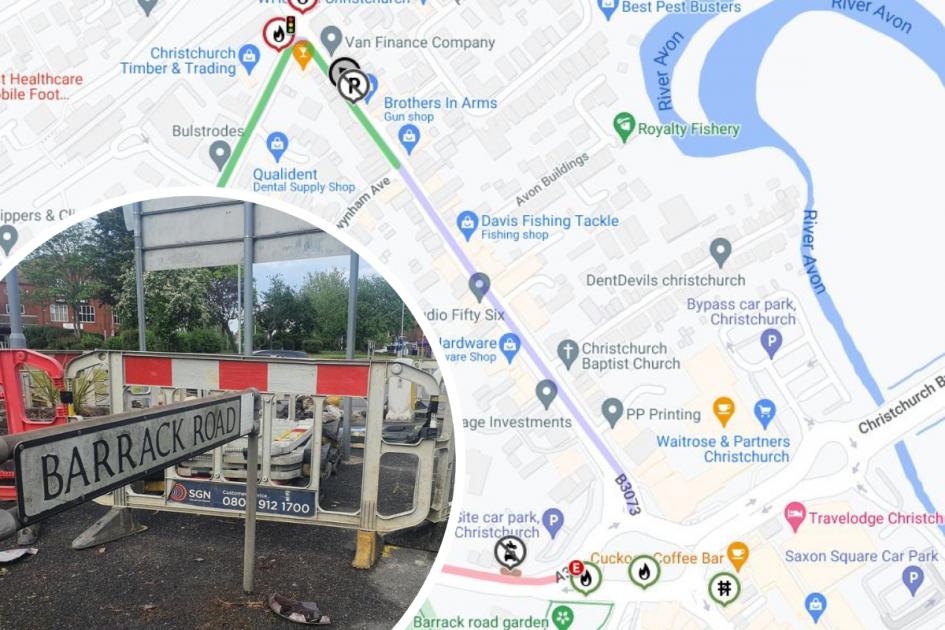

Read More »Barrack Road Gas Plant: Full Information and Detour Route

Road users face five days of disruption from today as major repairs to a leaky pipe take place in Christchurch. The city is always bustling thanks to a bypass running through the center of town, and any work on a key thoroughfare, rumbles into surrounding roads and alternate routes. Work …

Read More »Swanage Railway will return with its Steam and Lights train

A Dorset railway has revealed its plans for the festive season which include the return of popular train travel. Swanage Railway will return with its Steam and Lights train this Christmas, an hour-long evening journey described as “a memorable experience”. It sees passengers take an hour-long nighttime journey in festively …

Read More »Support Services for Victims of County Line Exploits Receives Increased Funding

The Home Office has allocated up to £5million to support victims of county line mining over the next three years. Hundreds of victims will be helped to escape drug gangs following the expansion of support services in London, the West Midlands, Merseyside and Greater Manchester. These are the largest export …

Read More »Dairy farm fined £52,000 for cruelty to cows

A West Dorset dairy farm has pleaded guilty to causing unnecessary suffering to a cow and calf by failing to care for them, along with a range of other offenses relating to conditions on their farm. Ireosa Ltd, which operates the Higher Kingston Russell farm near Winterborne Abbas, appeared at …

Read More »3,255 sheep sold at Dingwall and Highlands Marts with ‘firm investigation’ for Cheviot gimmers

DINGWALL and Highlands Marts Ltd sold 3255 breeding and storage sheep yesterday. Breeding ewes (1,664) sold at £155 gross for a Cheviots paddock at 13 Lochside, Lairg. Feed the Ewes (492) sold at £194 gross for a Texel from 379A Garynamonia, South Uist. Gimmers (631) sold at £200 gross for …

Read More »6 benefits of using a debit card instead of a credit card — Hometown Station | KHTS FM 98.1 & AM 1220 — Santa Clarita Radio

For many of us, pulling out a credit card and using it to pay for anything and everything is second nature; a reflex that we have developed over the years. However, if you also have a debit card in your wallet or purse, it’s often best to use it to …

Read More »The remote corners of Britain you can still reach without a car

Take things further afield by strolling to lesser-known beaches. Kingsdown is about a 40 minute walk from Deal and has a secluded shingle beach where seals can be spotted. For the ultimate sense of space, head to otherworldly Dungeness (via train and bus), which has been dubbed “Britain’s only desert” …

Read More »Premier League star Sylvain Distin opens school playground

A PREMIER League footballer and former Cherries star has opened a school’s new playground in Dorset. Frenchman Sylvain Distin cut the ribbon for the new playground at Pamhill First School and played football with the children. Sylvain, who has also played for Manchester City, Newcastle, Everton and Portsmouth, described the …

Read More »Rail services between Dorset and Somerset canceled for six days

Trains between Dorset and Somerset are expected to be affected by major rail improvement schemes. Network Rail is undertaking essential maintenance at Dorchester West as well as a number of stations in Somerset. As a result, Great Western Railway (GWR) will not be able to operate services between Weymouth and …

Read More »PNC Auto Loan Review | Find the best loan for you

What types of car loans does PNC offer? PNC Bank offers financing for new and used vehicles. If you apply online, you can get financing for purchases at eligible US dealerships. Car loans for personal purchases are also available, but you must apply in person at a branch. If you …

Read More »Queen’s funeral: seven more days of mourning after the Queen’s state funeral

The Royal Family will observe another week of mourning for the Queen after her state funeral on Monday. King Charles III decreed on September 9, the day after the Queen died after her 70-year reign, that a period of mourning would be observed for up to seven days after the …

Read More »Pumpkin fields in the wooded area

Autumn is here and pumpkins too! Get the perfect pumpkin, make memories and snap fall photos at these local pumpkin patch. OLD MACDONALD FARM – Have a day of pumpkin picking while enjoying train rides, pony rides and the farm’s petting zoo. The farm is set up with decorations, photo …

Read More »Keynote on Racial Healing with Anneliese Singh

About this event 2810 Cates Ave, Raleigh, NC 27606 See the map Free event Add to calendar Please join the author, researcher and speaker Anneliese Singh for “Racial Healing: Practical Activities to Help You Explore Racial Privilege, Confront Systemic Racism, and Engage in Collective Healing.” In this talk, Singh will …

Read More »Dorset town centers empty ahead of Queen’s funeral

Never since confinement have we seen our cities so deserted. Bournemouth, Christchurch and Poole were incredibly empty on Monday morning as people gathered with family and friends back home to attend Her Majesty The Queen’s funeral at Westminster Abbey. Roads were calm and shops closed ahead of the capital ceremony …

Read More »Discover Kissimmee Named Official Travel Partner of the NFL London Games

Football, and the NFL, is huge in the United States. Across the Atlantic in Europe, especially the UK, taking a “vacation” to Central Florida, namely Osceola County, is just as huge. And now Experience Kissimmee, Osceola County’s tourism marketing arm, has reached an agreement to tie the two together. Last …

Read More »Isak’s penalty gives Newcastle a point at home to Bournemouth

NEWCASTLE, England (AP) — Alexander Isak saved a point for Newcastle with his first goal at St. James’ Park, converting a penalty in a 1-1 draw with Bournemouth in the English Premier League on Saturday. The Swedish striker sent Brazil keeper Neto the wrong way in the 67th minute, five …

Read More »Dogs, cats, rabbits and goats looking for forever homes

Dexter the German Shepherd is one of a number of animals looking for their forever homes this week. Dorset-based animal rescue center Margaret Green is looking to find permanent homes for these dogs, cats, rabbits and goats. Can you help ? All the details are below. Dexter Dexter is a …

Read More »What will happen today after the death of the queen?

Friday marks D+7, or D+7, in plans marking the Queen’s death. Here is the timeline of events that are expected to take place over the next 24 hours. Visiting Wales: King Charles and the Queen Consort will travel to Wales by helicopter where they will attend a service of prayer …

Read More »Best Bad Credit Loans and No Credit Check Loans with Guaranteed Approval in 2022

Best Loans for Bad Credit: Get No Credit Check Loans with Guaranteed Approval Unless you can see the future, you cannot predict an emergency. So if a financial emergency arises and you are not well prepared, you will need a reliable solution to help you get through the trouble. At …

Read More »ISP Zzoomm Adds 8 New Cities to UK FTTP Broadband Rollout

UK network operator and ISP Zzoomm today announced a further £44 million expansion of its efforts to roll out a new gigabit-enabled Fibre-to-the-Premises (FTTP) broadband network, which will add 8 more market towns in parts of Yorkshire and the Midlands this autumn. So far the provider, which launched in 2020 …

Read More »Visiting Brattleboro, Vermont and Keene, New Hampshire: Things to Do This Fall

Robert Frost’s ‘nothing golden can remain’ maxim rings especially true this season as the fleeting golden, orange and red foliage of autumn peaks in the poet’s home states of Vermont and neighboring New Hampshire. . But that brief and gloriously Instagrammable fall color can still be captured on a weekend …

Read More »BCP advice on this year’s Christmas celebrations

The Christmas parties organized by the municipality will not be minimized despite the cost of living crisis. Illuminations, ice rinks and festive markets will make their big comeback in the agglomeration this Christmas. Although full details have yet to emerge, city leaders have insisted the events in Bournemouth and Poole …

Read More »Robert Harris among the authors at the Dorchester Literary Festival

An eclectic and ambitious lineup has been announced for an upcoming book celebration. Now in its eighth year, the Dorchester Literary Festival will run from October 15-22 and the organizers are delighted to have recruited some of the best authors. In a bit of a bang for the festival, ‘page-turner …

Read More » Welcome To Poole

Welcome To Poole

_w=1200_h=630.png?v=20220321141806)

_w=1200_h=630.png?v=20220321141806)